Tax Planning & Compliance

Our relationship with you is based on achieving results, and smart tax planning is essential for maximizing savings and protecting your growth. Every day, we focus on delivering tax strategies that keep you compliant and financially optimized. Our services include:

- Tax planning and advisory

- Corporate and personal tax returns

- Tax compliance and reporting

- Strategic deductions and credits optimization

- Audit support and representation

- Year-round tax consultation

Finx consultancy

How Our Taxation Services Can Help Grow Your Business

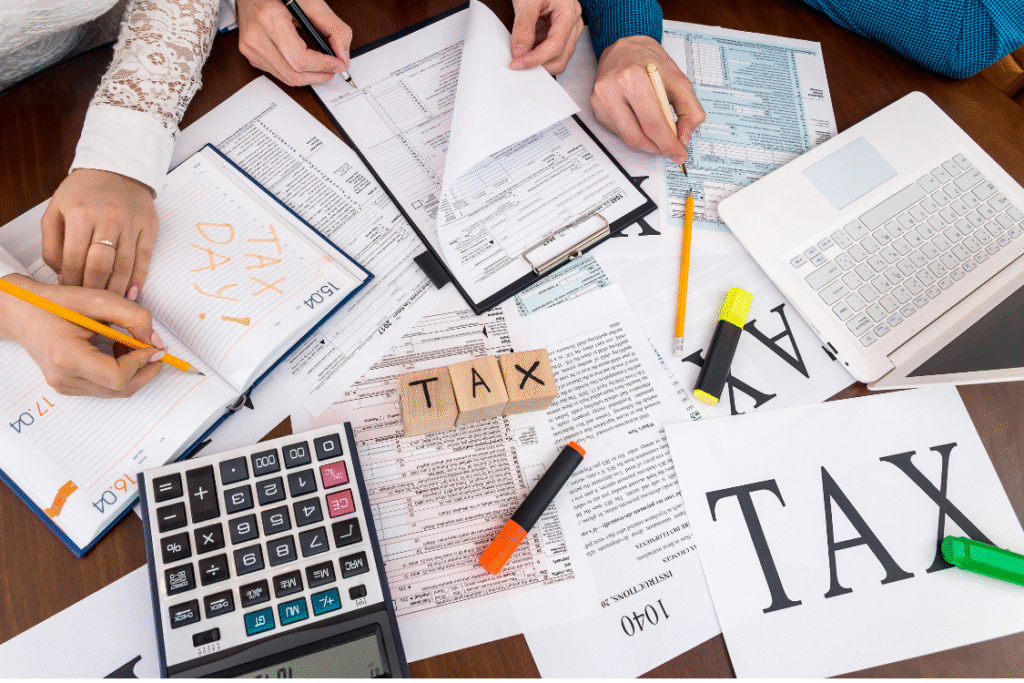

Combining Compliance with Strategic Tax Savings

Good taxation isn’t just about filing returns. Many businesses leave money on the table because they don’t utilize strategic tax planning throughout the year.

Our taxation experts go beyond basic compliance. We work closely with you to develop personalized strategies that reduce liabilities, maximize deductions, and ensure you stay ahead of regulatory changes — helping you keep more of what you earn and fueling future growth.

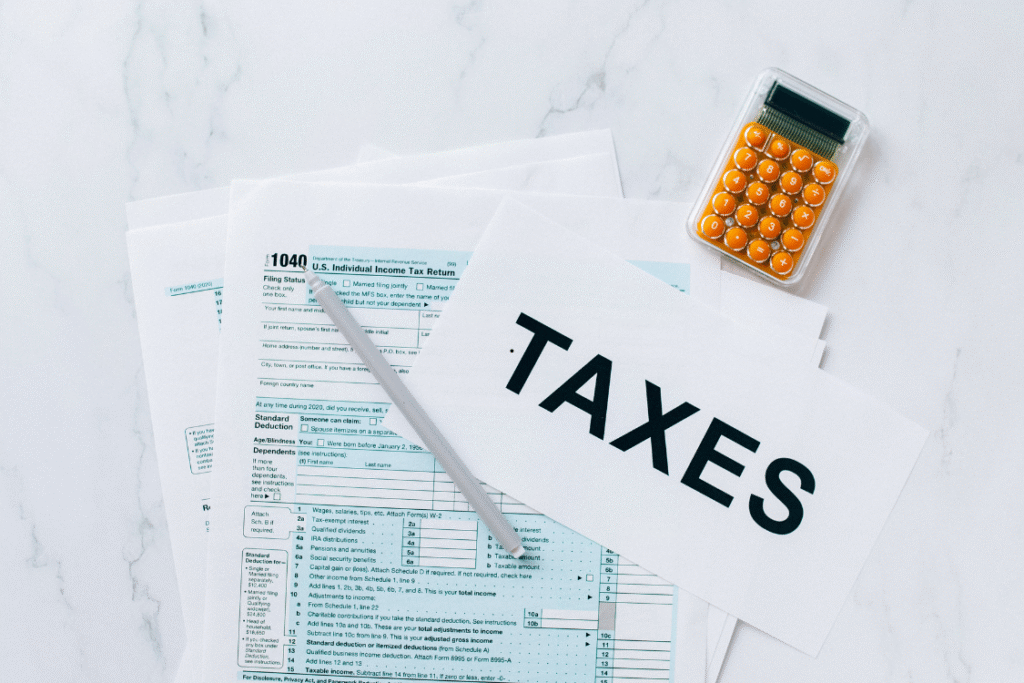

Real Experienced Tax Professionals

Work with seasoned tax professionals who stay current with ever-evolving tax laws and regulations. Our team ensures that your business remains compliant while uncovering opportunities to legally minimize your tax burden and improve financial efficiency.

The proof is in the numbers

Why Smart Taxation Strategies Matter

38%

Of businesses that invest in proactive tax planning report improved profitability.

56%

Of small businesses experience reduced audit risks with expert tax advisory.

71%

Of businesses leveraging smart tax strategies retain more earnings annually.

FAQ

FAQs About Taxation Services

Looking to learn more about taxation services for your business? Browse our FAQs:

Taxation services cover tax planning, filing corporate and personal returns, compliance support, audit representation, and advice on optimizing deductions and credits.

Effective tax planning reduces liabilities, protects against audits, maximizes deductions, and supports long-term financial health and business growth.

Yes, we offer comprehensive taxation solutions for both businesses and individuals to ensure complete and strategic tax management.

Ideally, tax strategies should be reviewed at least once a year, or whenever significant changes occur in your business or personal financial situation.